BUTTER AND BEEF – HIGH PRICES FOR THE SAME REASONS, BUT FARMERS ARE NOT GETTING ANY RICHER…

The price of butter has been going through the roof and shops in France have been running out of it while the raw material it is made from, milk, costs next to nothing.

How can this paradox be explained?

Butter has been selling at stratospheric price levels over the past few months (€7,000 per tonne) and some French supermarket chains have been running out of it.

French dairy farmers have been forced, over the past few years, to lower their prices. Their prices – which currently stand at €350 per 1,000 liters – do not enable them to make money from their farms.

“This appears to be the paradox at the moment”, acknowledges Dominique Chargé, the Chair of the Fédération Nationale des Coopératives Laitières (FNCL, the national federation of milk cooperatives), “but it is not one when you understand what is actually happening”.

The steep rise in the price of butter can be explained, firstly, by increased demand from Asian countries, who are being tempted by the western lifestyle, and secondly, by increased sales in western countries, notably in France.

“A decade ago, everybody was convinced that there was a problem with butter, that it wasn’t good for your health and that only producing protein – and not fat – was the future of the dairy industry. Yet now the situation has been turned on its head, since nutritionists have told us that protein is bad and that butter is good. Consumers have thus started eating more of it, and also the [food] industry has sought substitutes for palm oil”, explains Dominique Chargé.

But to understand the price paradox about milk and butter, you need to examine the ways in which they are produced :

To produce butter, only cream – which makes up a small proportion of milk – is used. About 1,000 liters of milk are required to produce 45kg of butter. The rest of the milk is processed into milk powder (90kg of it) and into buttermilk (which is mainly made up of water), which is used by the food industry, but which is very cheap.

In other words, when 45kg of butter is produced, twice that of milk powder in quantity terms must be sold.

But the latter is not highly valued.

“Milk powder is a co-product, and one which doesn’t have a great value. It is less profitable to produce and as a result the price of the prestigious substance – butter – is going through the roof”, explains Dominique Chargé.

Thus, “Dairy industry companies could produce much more milk powder, but it would not be profitable, because they would then have to sell the milk powder, and it does not make them much money”, according to the Chair of the FNCL.

The end result? The dairy industry places the emphasis on high added-value segments which are growing strongly, such as cheese, and mainly mozzarella, cheddar, and Emmental, which are used in preparations by food manufacturing companies in their recipes – in pizzas and hamburgers, for instance.

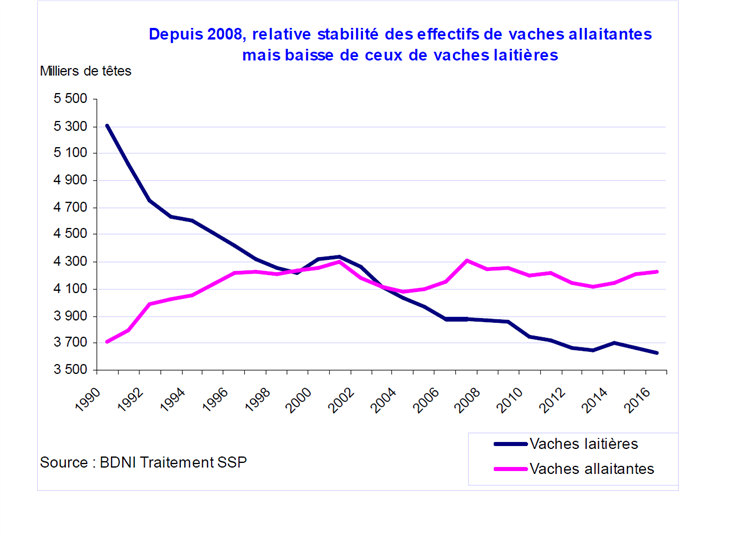

The impact on beef has not thus only been caused by the end of milk quotas and the resultant reduction in herds. But there are great similarities in the forces at play in these two interlinked markets.

Given the lack of sufficient outlets for sales on the French domestic consumer market and on the export consumer market, the market for meat to be used as mince has aligned the prices for “high-quality” beef (coeur de gamme) and those paid for cows previously used to produce milk (milk cows), and other light cattle intended for processing into mince.

The 1% per annum growth of the minced meat market has caused some casualties – for example, specialized producers of beef – as paradoxical as that may seem.

The mince market now accounts for 42% of the various types of beef purchased by households. And the more its market share grows, the more difficult it makes it to get a good price for animals from milk cow herds!

The drop in spending power in France does not account, on its own, for this vogue for “budget” or “low-cost” products. Growth in the consumption of minced meat – fresh, frozen or in preparations – above all flags a change of eating habits and of consumers’ tastes, so much has the trend turned into a phenomenon.

Sold in supermarkets and in fast-food chains, these products are completely in line with the current lifestyle. As regards the food service (or catering) industry, the consumption of minced meat has been boosted by the surge in popularity of the burger, both in the fast-food sector and in the conventional restaurant sector, in both of which restaurants generate better margins than with their dishes featuring cuts of meat.

When less milk cows are slaughtered, the prices paid for all types of cattle, as a whole, will be pushed upwards, which will increase, by means of a ricochet effect, volatility on the minced meat market.

Even in the conventional meat aisles in large supermarket chains, heavy animals have fallen out of favor, since after processing they no longer meet the requirements of consumers.

To the extent that 95,000 carcasses, each weighing in excess of 450 kilos, are now earmarked for processing into minced meat!

The end result? The price of minced meat and the price of meat for use in industrial preparations is going through the roof, and paradoxically, there is not enough of it, since the sacrosanct balance in terms of raw materials as regards meat is not being achieved – “Rib eye steaks and sirloin steaks are staying in the fridge” – and the supply of raw materials, and especially the supply of French beef, is not meeting demand.

In 2018, the trend is expected to continue. Watch this space!

For more information :